With the implementation of Goods and Services Tax from 1st July 2017, as a registered business entity we need to issue a GST invoice whenever the supply of taxable goods or services is made.

There are two types of GST invoice under the GST regime. Those businesses registered under the general category will issue a GST Tax Invoice. Those businesses registered under the Composition Scheme will issue a Bill of Supply.

Table of Contents

Depending on the nature of the supply you can define 3 types of invoices:

A business has to issue an Intra-state invoice when the supply is done within the state in which the business is registered. The issuer of the invoice has to collect CGST and SGST on this invoice.

Example: Goods sold by a business registered in Gujarat State to another business in Gujarat State. The product is liable for the collection of 5% GST, then 2.5 % CGST and 2.5% SGST has to be deducted on the taxable value.

When a supply takes place between two different states the business needs to issue an Inter-state invoice. The business needs to collect IGST on this invoice.

Example: Goods sold by a business registered in Gujarat State to another business in Maharashtra State. The product is liable for the collection of 5% IGST has to be deducted on the taxable value.

When supply is made outside the country, an Export Invoice is issued.

The government has defined some rules for issuance of GST Invoices. Subject to rule 7, a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars:-

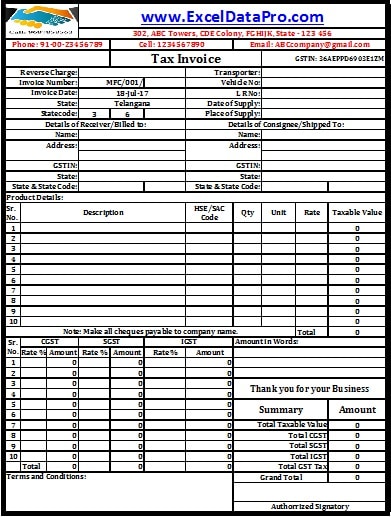

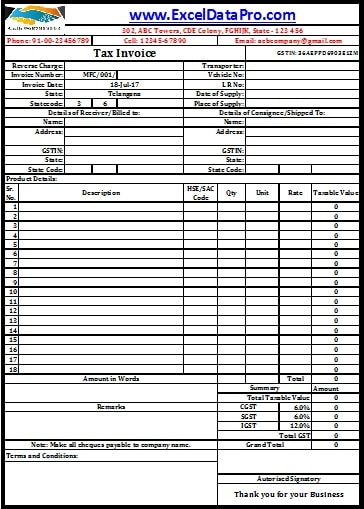

Keeping in mind the rules we have created 10 different formats of invoice under the GST regime. All formats vary in terms of design, industry, calculation method, etc.

Just enter a few details and the template will compute all the rest items for you. It is useful for Accounts Assistant, Accountants, Audit Assistants, etc.

This template helps you to efficiently and easily issue the invoices to your clients with CGST, SGST, and IGST Computations.

Let us discuss the contents of each template in detail.

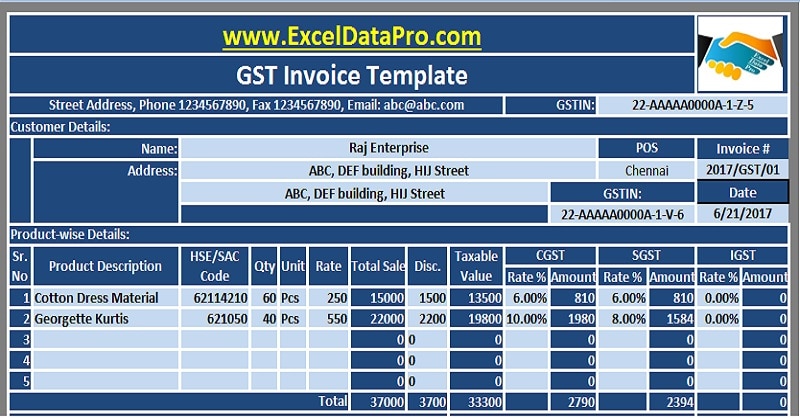

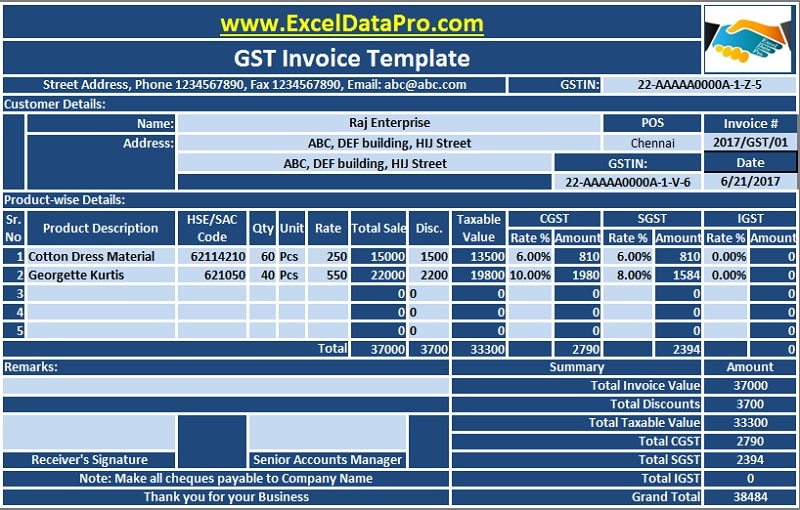

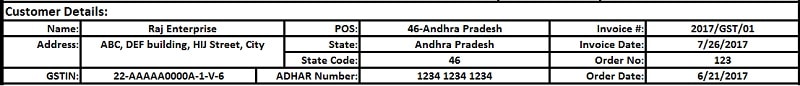

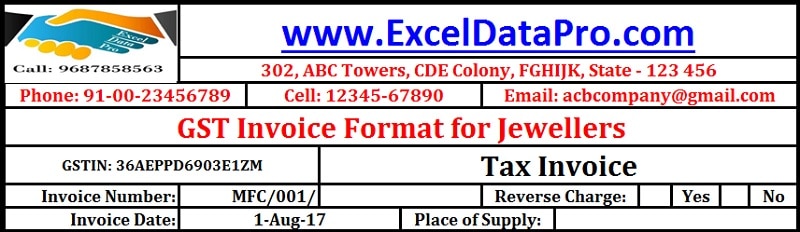

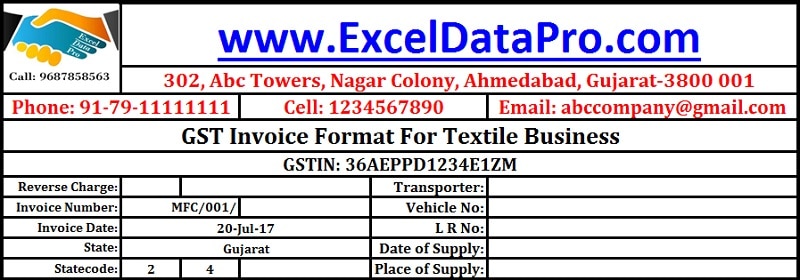

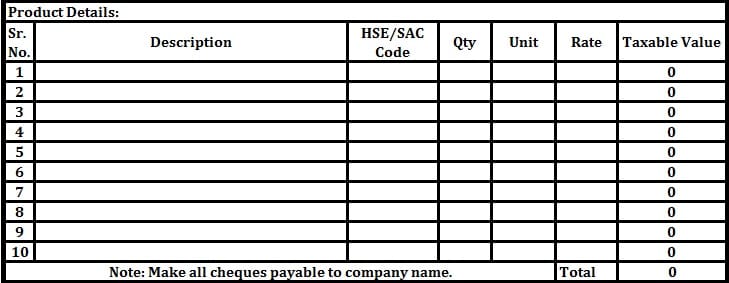

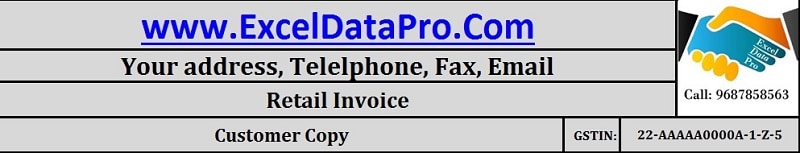

GST Invoice Format template consists of 5 sections; Header Section, Customer Details Section, Product & Tax Details Section, Billing Summary Section and Signature Section.

Header section consists of the company name, company address, company logo, GSTIN and the heading of the sheet “GST Invoice Template”.

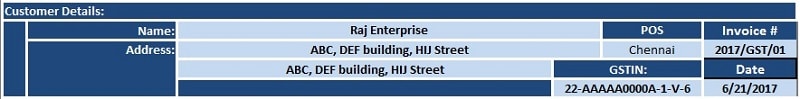

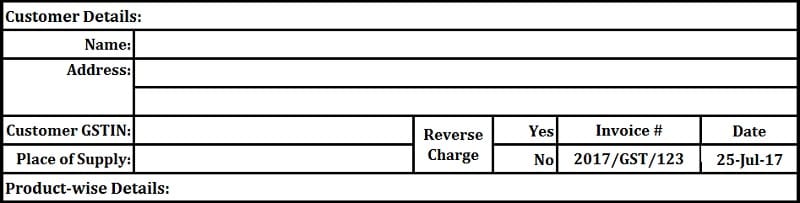

Customer Detail section consists of details of a customer such as the name of the customer, address, GSTIN, Invoice Number, Place of Supply (POS) and Invoice Date.

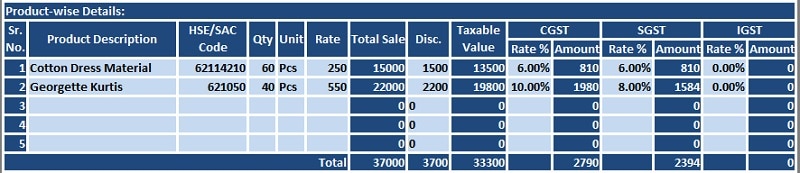

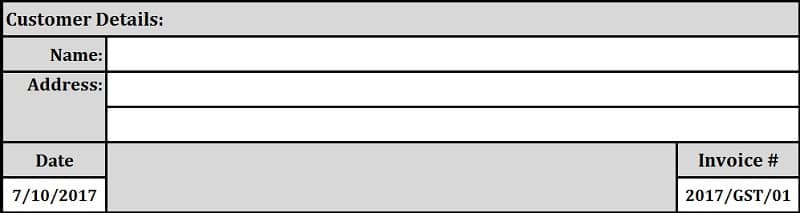

Product-wise tax deduction section consists of multiple subheadings. You need to enter Sr. No., Product Description, HSE/SAC Codes, Quantity, Units, Rate of Product, Discounts, CGST Rate, SGST Rate, and IGST Rate.

These all amounts; Total Sale, Taxable Value, CGST Amount, SGST Amount, IGSTAmount and Final Invoice Total will be automatically calculated.

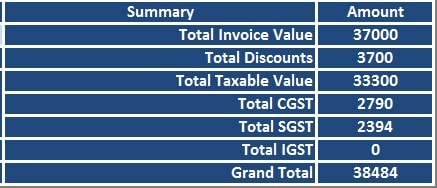

The Summary section consists of the total billing amount payable by the customer.

Signature Section consists of miscellaneous items like remarks, business greeting and Signatures of the receiver of the invoice and the accountant.

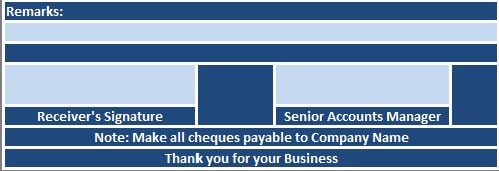

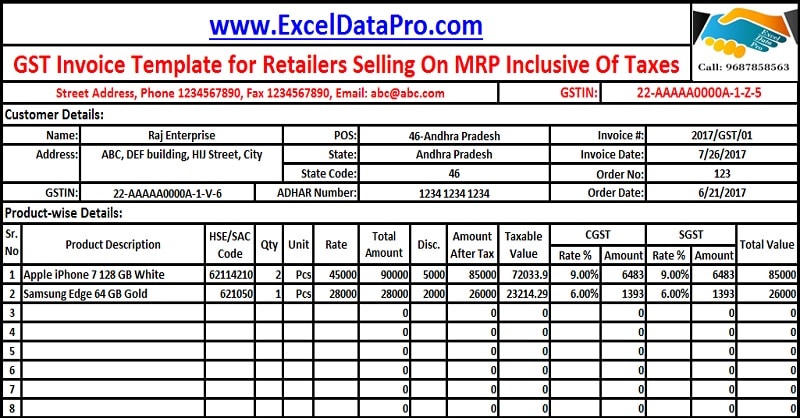

A person selling branded goods or goods with predefined MRP (maximum retail price) that is inclusive of taxes will require this GST Invoice format for selling goods on MRP inclusive of taxes.

This template contains reverse calculations which will extract the tax amount from the MRP.

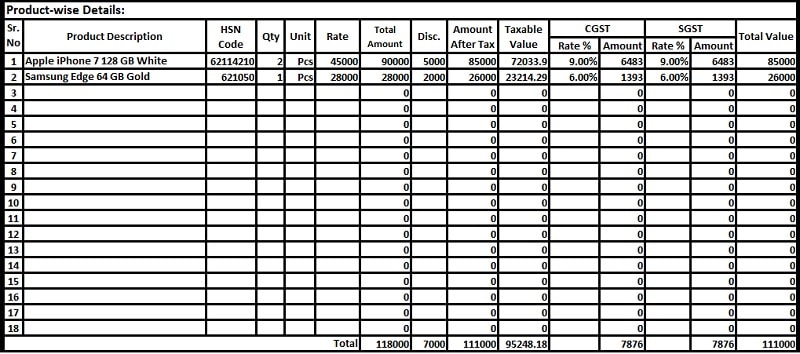

This template consists of 4 sections; Supplier Detail, Customer Detail, Product Detail, Billing Summary, and Remarks section.

The header section consists of supplier details such as company name, logo, address, GST number, etc.

Customer detail section contains fields such as customer name, address, GST number, Place of supply, State, State Code.

You need to enter Sr. No., Product Description, HSE/SAC Codes, Quantity, Units, Rate of Product, Discounts, CGST Rate, SGST Rate, and IGST Rate.

These all amounts; Total Sale, Taxable Value, CGST Amount, SGST Amount, IGSTAmount and Final Invoice Total will be automatically calculated.

Billing summary consists of fields like Amount in words, Remarks, business greetings, company seal, authorized signatory, Invoice value, discounts, total taxable value, the grand total of the invoice, etc.

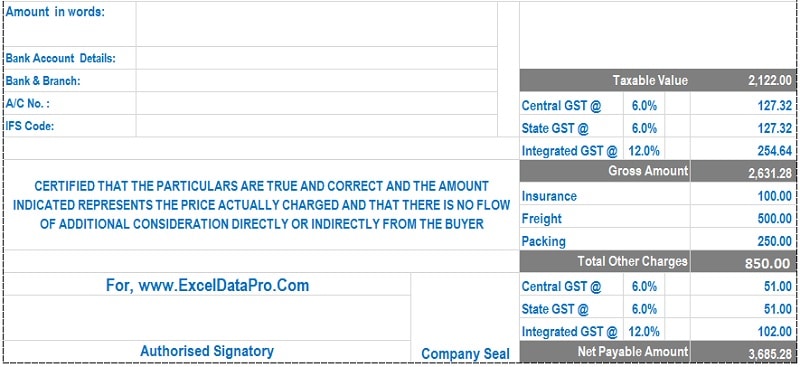

Since the rollout of GST in July, people are still confused about how to include freight, insurance and packing, etc charges in GST Tax Invoice.

Business needs to issue the invoice which carries such additional charges. So how will they be recorded?

If such charges are included in the tax invoice then:

It should be kept in mind, GST applicable on GTA services is 5%. But when you include it in your invoice it will be taxed at the applicable GST rate of goods even if the tax rate is higher than 5%.

A simple way to avoid higher payment of tax, freight charges shall be borne by the recipient of the goods.

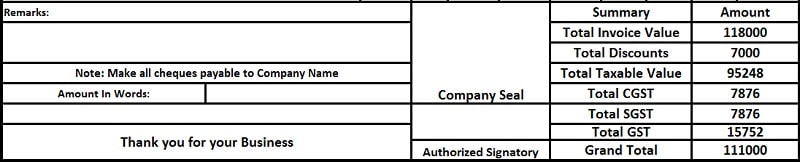

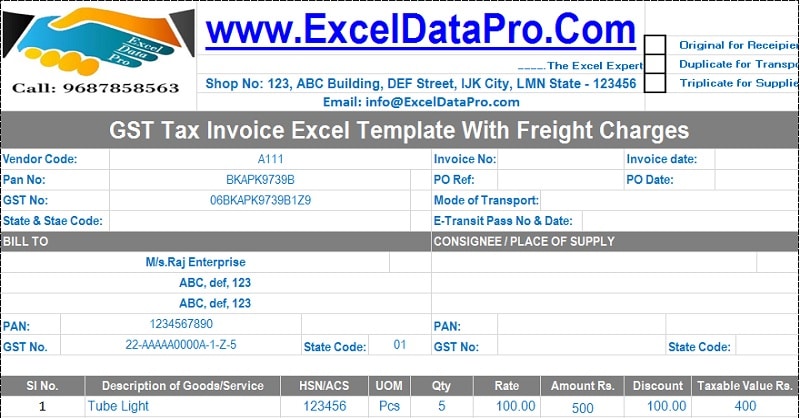

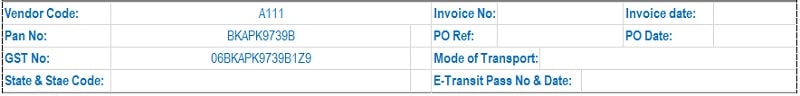

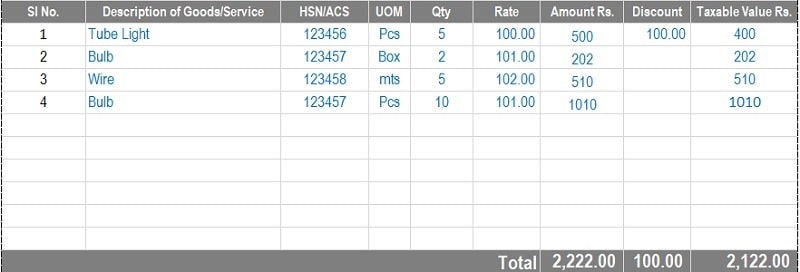

As usual, the header section consists of the supplier’s company name, address, logo, etc.

Supplier’s details include Vendor Code if applicable, GSTIN, Pan, State, State code, Invoice no, Invoice Date, mode of transport, E-transit pass, date, etc.

Receiver’s details include name, address, PAN No, GSTIN, State and State code. If the delivery is different from the receiver then you can mention them manually in consignee details.

Product details section consists Serial number, Description of goods, HSN code, Unit of measurement, Quantity, Rate, Amount, discount and the Taxable amount

Billing Summary consists of the gross value with taxes, other charges (freight, packing, insurance, etc), tax on these charges, and Net Payable Amount.

Gross Amount = Taxable Value + CGST + SGST +IGST

Total Other Charges = Insurance + Freight + Packing

Net Payable Amount = Gross Amount + Other Charges + Tax On Other Charges.

Apart from that, this section consists of Amount in Words, Term & Conditions, Signature, company seal and bank details.

Usually, a jeweler sales new gold and also takes old gold of the customer.

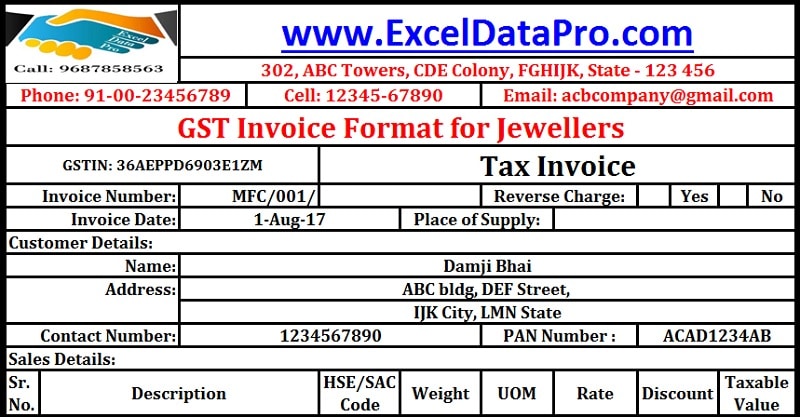

Keeping this process of the transaction in mind, we have designed a GST invoice format for Jewellers in Excel. Using this template you can issue the invoice to your retail customers.

This template consists of 5 sections: Jeweler’s Details, Customer Details, Sales Details, Exchange Details, and Taxation and Billing Summary.

Jeweler’s details include the company name, address, contact details, GSTIN and the heading of the invoice “Tax Invoice”.

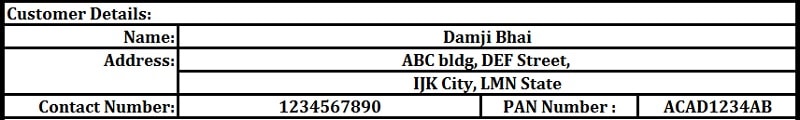

Customer details include name, address, contact number and pan card number as per the GST rules.

As this is a retail transaction where the invoice is issued directly to the customer, it belongs to the B2C category. Hence, it doesn’t require GSTIN of the customer. Instead of GSTIN, PAN card details of the customer are obtained.

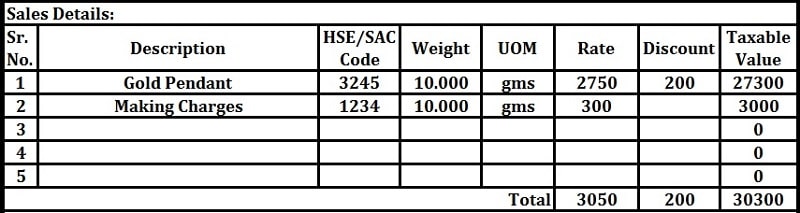

Sales details include the details sale of ornaments, making charges, etc.

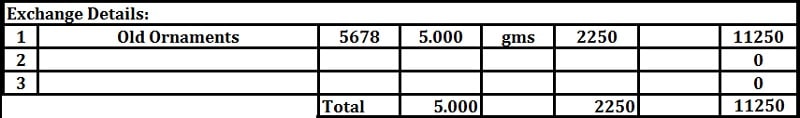

Exchange details contain the same columns as Sales details. Only Discount is not applicable in exchange.

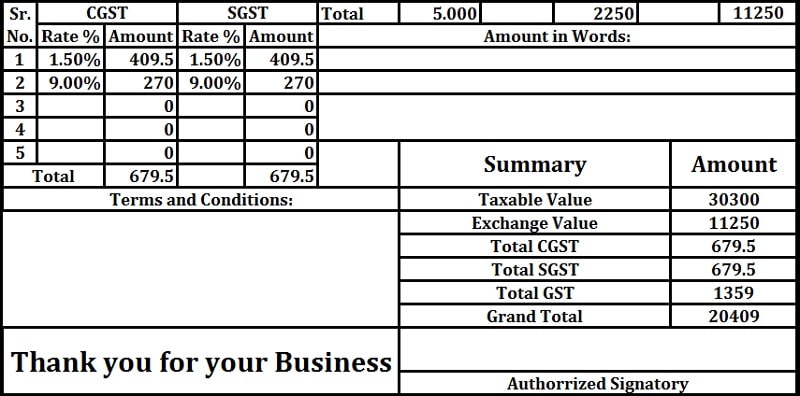

Taxation section consists of taxation details only on the sales made and not on exchange.

As per GST law when there is the exchange of precious material there is no GST applicable as the customer is non-registered.

Apart from the taxation, this section also consists of a billing summary, the amount in words, invoice terms & conditions, business greetings, and the signature section.

Manufacturers outsource a major portion of their activities to Job Workers. A job worker will then issue a tax invoice for that portion of activities which can be claimed by the manufacturer in Input Tax Credit (ITC).

This template will be helpful especially to the textile industry and other manufacturing industries that involve job work process.

To know more about the Job Work Process under GST click the link below:

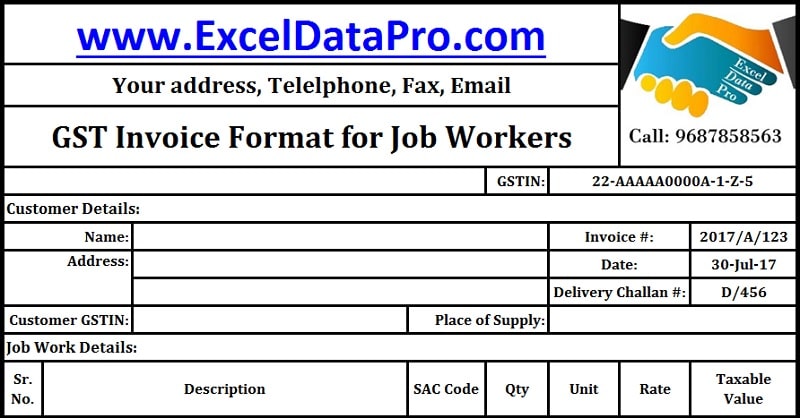

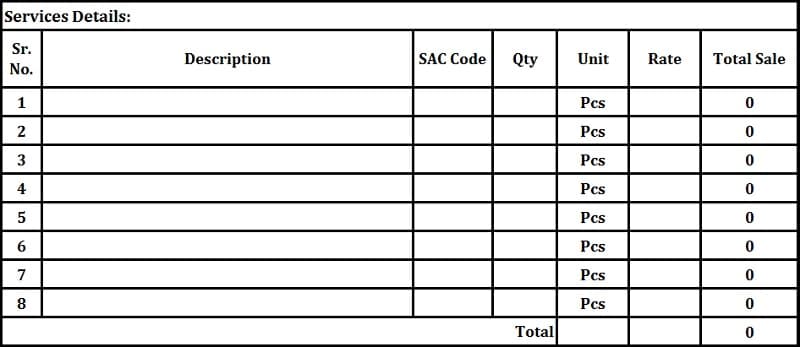

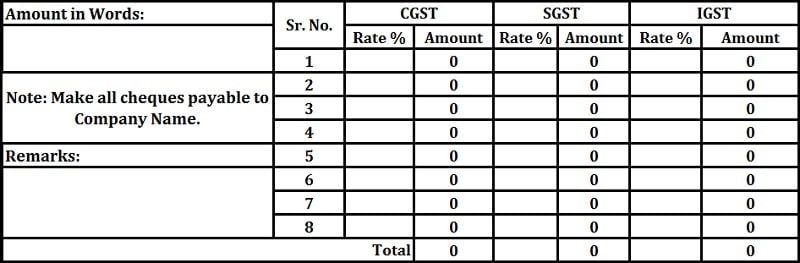

This template contains 5 different sections: Job Worker’s Details, Customer Details, Job Work Details, Taxation Details, Remarks, Billing Summary, and Term & Conditions section.

Job Workers detail consists of the company name, address, and logo.

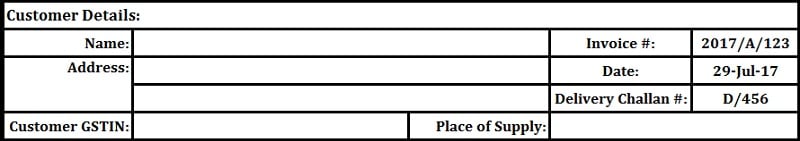

Customer Details section consists of customer name, address, GST number, invoice number, place of supply, date and the delivery challan against which he has received the material for job work.

The manufacturer will issue a delivery challan to the job worker at the time of the movement of goods without tax to his location.

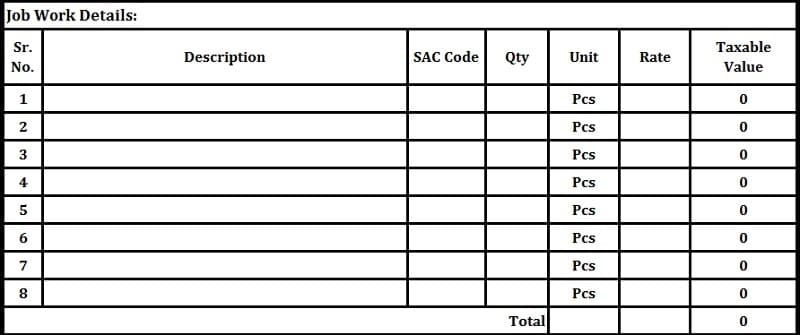

Job work details section contains Sr. No., Product Description, SAC Codes, Quantity, Units, Rate of Product, Discounts, CGST Rate, SGST Rate, and IGST Rate.

These all amounts; Total Sale, Taxable Value, CGST Amount, SGST Amount, IGSTAmount and Final Invoice Total will be automatically calculated.

The last section consists of Terms & conditions along with the billing summary and business greetings.

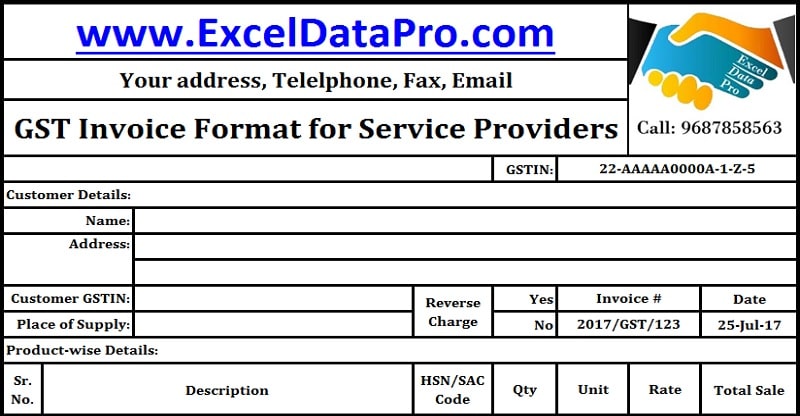

GST Invoice format for service providers is almost similar to the GST Invoice format issued for goods suppliers.

The major difference is the Services Accounting Code (SAC code) to mentioned instead of the Harmonised System of Nomenclature Code (HSN Code).

This template contains 5 sections: Service Provider Detail, Customer Detail, Product Detail, Taxation & Remarks Terms & Conditions, and Billing Summary.

Service provider detail consists of the service provider’s company name, address, logo, GSTIN(GST Number), etc

The customer details include customer name, customer address, and customer GSTIN. In addition to that, it contains the place of supply, invoice date, invoice number and applicability of reverse charge.

Services Detail consists details like serial number, description, SAC code, quantity if applicable, units, rate and Total Sale.

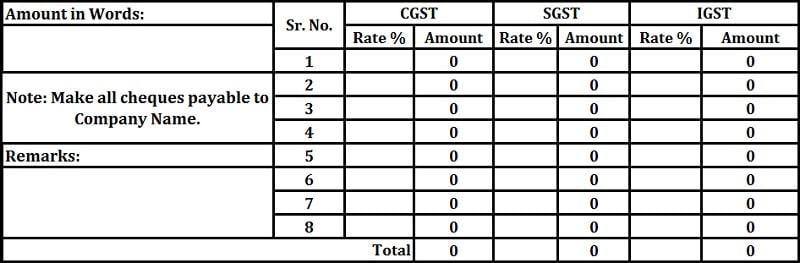

Taxation and remarks section consists of 3 columns with 2 sub column each for CGST, SGST, and IGST.

Additionally, it also has “Amount in words” and “Remark” areas.

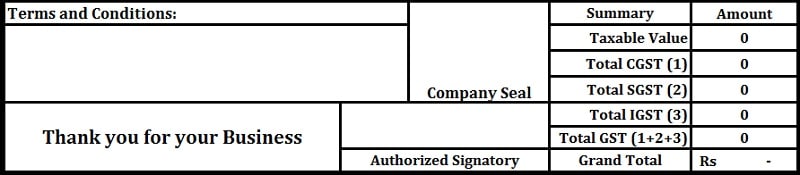

Lastly, Terms and conditions along with the billing summary and business greetings are given.

Billing Summary can be either: Invoice Value + CGST + GST + IGST = Grand Total or Invoice Value + Total GST = Grand Total.

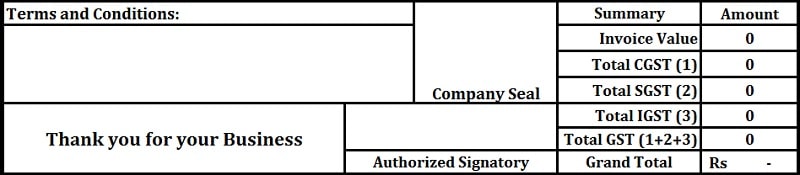

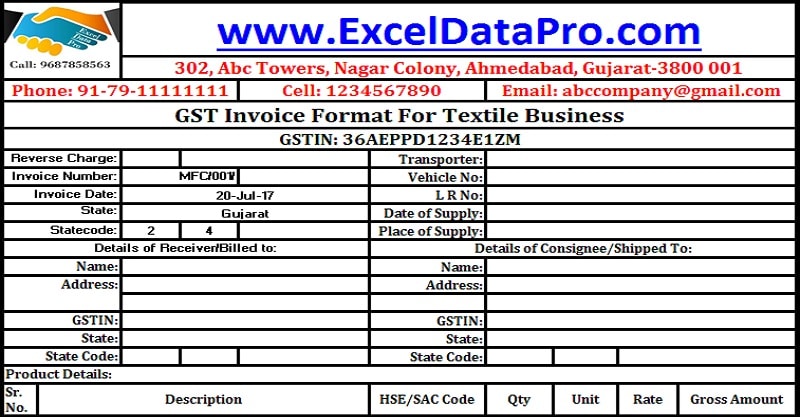

A single tax of 5% is applicable to the Textile Industry. Thus, a single tax column invoice format will be applicable.

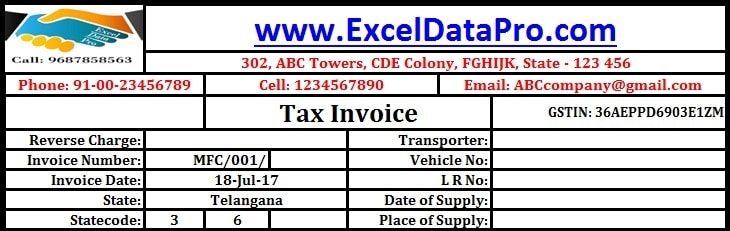

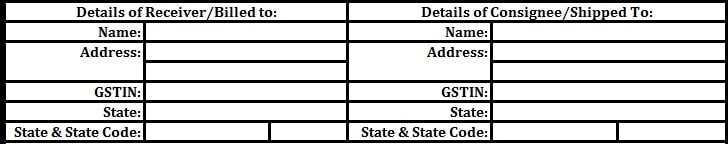

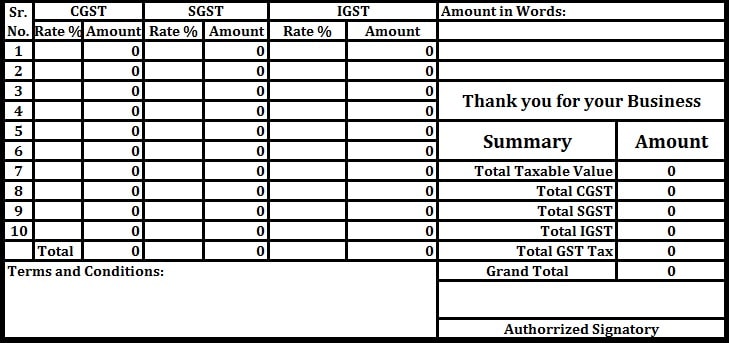

This template contains 4 different sections: Supplier Details, Receiver/Consignee Details, Product Details, Billing Summary, Tax, and Signature Section.

Usually, the supplier details section consists of the company logo, company name, address, GSTIN and contact details or you can take a print of invoice on your letterhead.

It also contains columns for the reverse charge, invoice number, invoice date, date of supply, place of supply, transport details, state and state code, etc.

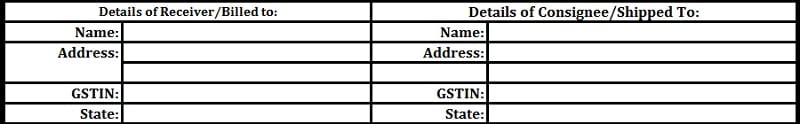

Receiver/Consignee details consist of the receiver and consignee name, address, GSTIN, state, state code, etc.

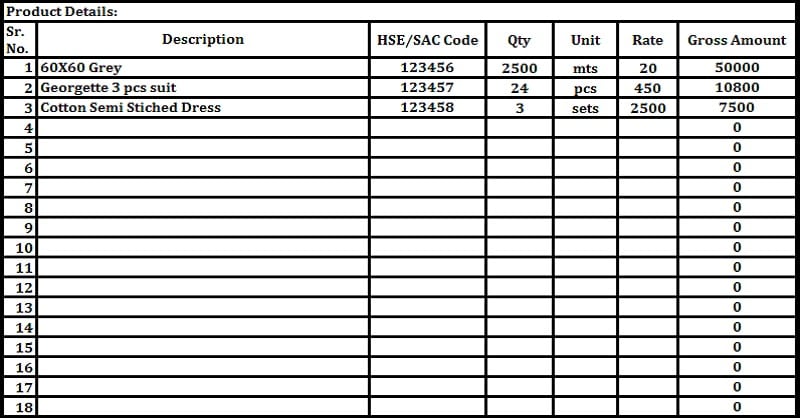

Product details section consists of product descriptions, serial number, quantity, unit, rate, and taxable value. Gross value = Quantity X Rate

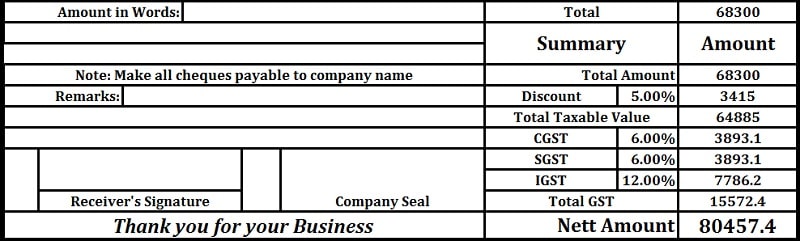

The billing summary consists of the following calculation:

Total Amount -Discount = Taxable Value

Total GST = CGST + SGST + IGST

Taxable Value + Total GST = Nett Amount

A separate column for the rate of tax applicable for each tax is provided. You enter applicable tax and it will compute automatically.

In addition to the above, it has the amount in words, remarks, business greetings, and space for the Authorized signatory.

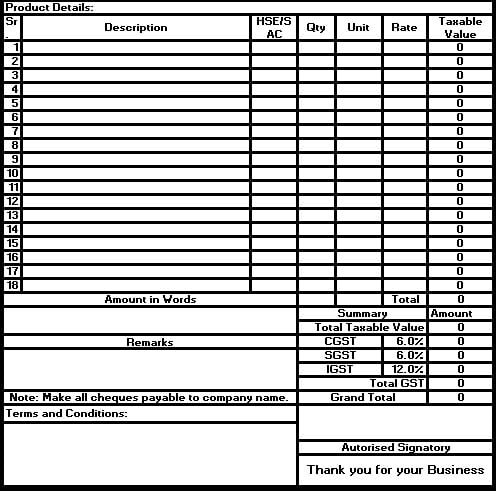

It consists following two types of GST Invoice templates:

1. With multiple tax columns, where different commodities on which different rate of GST is applicable.

2. With Single Tax columns, where one tax rate is applicable to all the items.

Similar to other invoices, Supplier detail section consists of the company logo, company name, address, GSTIN and contact details.

Receiver/Consignee details section contain the name, address, GSTIN, state and state code, etc of the receiver/consignee.

Product details include the product descriptions, serial number, quantity, unit, rate, and taxable value. Taxable value = Quantity X Rate

When single tax is applicable you get more space for products as the taxes are entered consolidated in billing summary section.

Tax section consists of rate and amount column for CGST, SGST, and IGST if applicable. If IGST is not applicable, then this column can be removed.

For single tax applicable, the tax applicable rate is to be mentioned in the billing summary as shown below:

Same as other invoices, Lastly, summary section consists of the billing summary, where: section consists of the calculation of the invoice.

In addition to the above, this section also consists of multiple cells for the amount in words, business greeting, terms & conditions, and the authorized signatory.

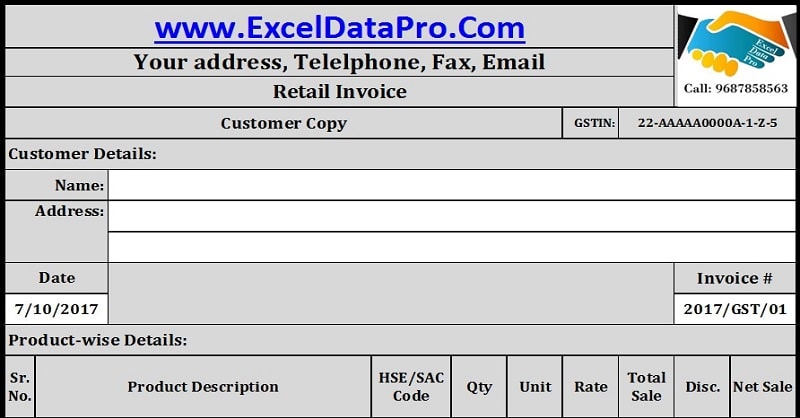

Retailers come under the rule of Composition scheme. Such registered taxable persons need to issue Bill of Supply.

Rules of GST Invoice Format for Retailers:

According to clause (c) of sub-section (3) of section 31/A for the bill of supply shall be issued by the supplier containing the following details:-

Provided further that any tax invoice or any other similar document issued under any other Act for the time being in force in respect of any non-taxable supply shall be treated as the bill of supply for the purposes of the Act.

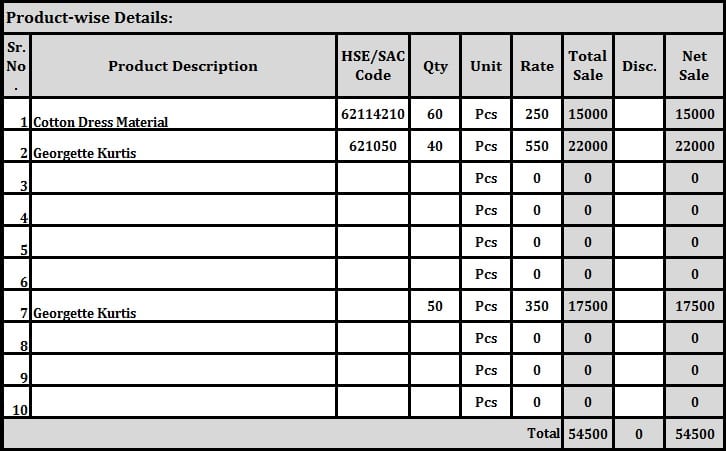

This template consists of 4 sections: Header Section, Customer Details Section, Product Details, Billing Summary, and Signature Section.

The header section includes company name, address, logo, GSTIN and the invoice title.

Customer Detail section consists of details of a customer such as the name of the customer, address if applicable, Invoice Number and Invoice Date.

Product details include the product descriptions, serial number, quantity, unit, rate, and taxable value.

The summary section consists of the total billing amount payable by the customer.

Signature Section contains miscellaneous items like remarks, the business greetings and the signatures box for the authorized signatory.

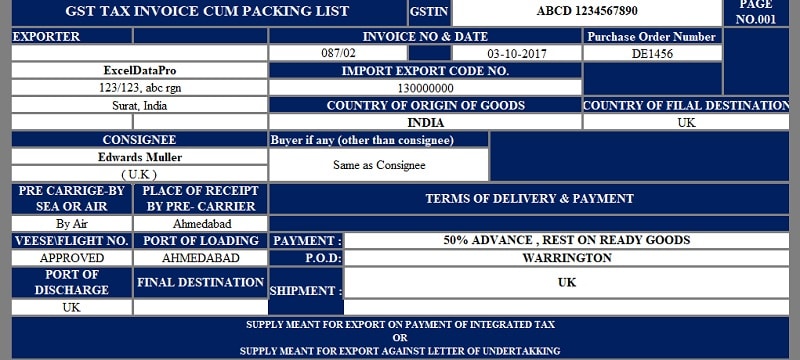

GST Export Invoice as per the rules that are given in GST Law 2017 by the Government.

Movement of goods for the purpose of export where IGST is leviable, it can be done in the following two ways:

This template is useful for Exporters whose supply involve paying of IGST (Integrated Goods and Service Tax).

Subject to rule 7, a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars:-

Provided also that in case of export of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be, and shall, in lieu of the details specified in clause (e), contain the following details:

(i) name and address of the recipient;

(ii) address of delivery; and

(iii) name of the country of destination:

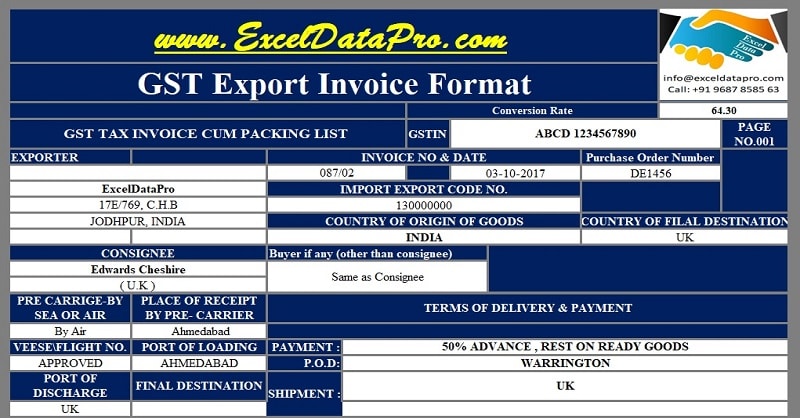

This template contains the following 5 sections: Header, Supplier and Customer Details, Billing Details and Signatory Section.

As usual, the header section consists of the company name, company address, and the company logo.

In addition to that, it consists of the conversion rate required which is required to input for the exchange rate of foreign currency.

This section consists of the following details:

Invoice heading

GSTIN

Invoice Page No

Exporter Details

Consignee Details

Invoice No and Date

Purchase Order Number

Import Export Code No (IEC)

Country of Origin of Goods

Country of Final Destination

Details of Buyer if it is other than the consignee

Pre Carriage by Sea or Air

Place of Receipt by Pre-Carrier

Vessel/Flight No

Port of Loading

Port of Discharge

Final Destination

Terms of Delivery and Payment

Payment Description

Point of Delivery (POD)

Shipment

At the end of this section, you need to mention an endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be.

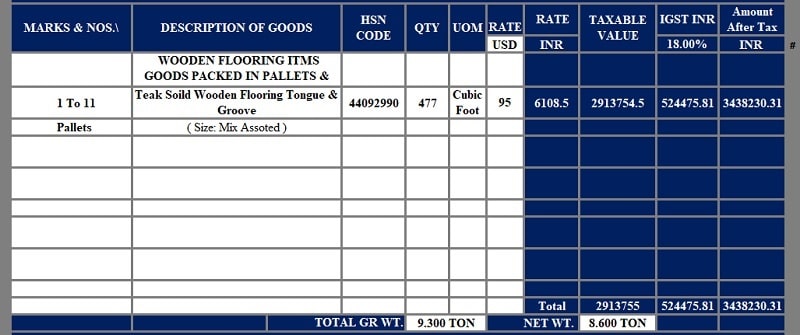

Billing Details consists of the following columns:

Marks and Nos

Description of Goods

HSN Code

Quantity

UOM

Rate (USD) or other applicable currency

Rate (INR)

Taxable Value

IGST (INR) and IGST percentage

Amount After Tax (INR)

Final Totals

Total GR WT (Gross Weight)

Total Net WT (Net Weight)

Signatory section consists of the final declaration and terms. In addition to that, it also consists of the signature box for the authorized signatory of the supplier.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

You are Here: Home / Excel Templates / GST Templates in Excel / Download 10 GST Invoice Templates in Excel

I have worked in Excel and like to share functional excel templates at ExcelDataPro.